All the videos are here.

This was an interesting Storage Field Day presentation for me as instead of a company that implements storage systems using the various components out there in the market, Western Digital actually makes the devices that feed all of these different solutions. This presentation was specific to the datacenter market (follow @WesternDigiDC), but don’t forget that for Western Digital the datacenter is not limited to the enterprise space, but also includes the hyper-scale datacenter, so some of the technologies like Shingled Magnetic Recording (SMR) are going to take a while before we see them in enterprise ready-solutions.

For those of you that don’t spend lots of time following the details of this part of the market, a quick update is in order since there are a number of key acquisitions made by Western Digital that make it much more than just a single-product component manufacturer.

-

HGST as part of the consolidation of the spinning hard disk space.

-

SanDisk to add to their partnership with Toshiba in the flash storage space.

-

Tegile for moving up the stack into producing flash arrays to help capture some more value from the storage market.

Highlights of the presentation covered the technical details on the 96 layer BiCS production of 3D NAND. One of the interesting tidbits that came out of that discussion was their ability to mix different densities (SLC, MLC, TLC, QLC) on the same production dies so that there will possibilities of mixing high endurance with high capacity if I understood correctly.

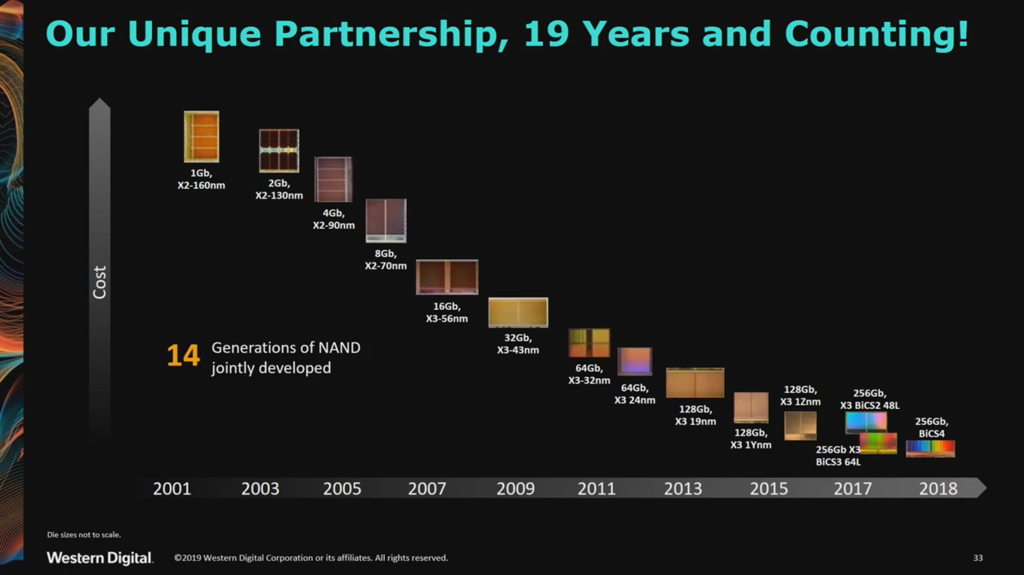

There was some good discussion around their partnership with Toshiba that dates back to 2001, while at the same time they are head to head competitors in the HDD space.

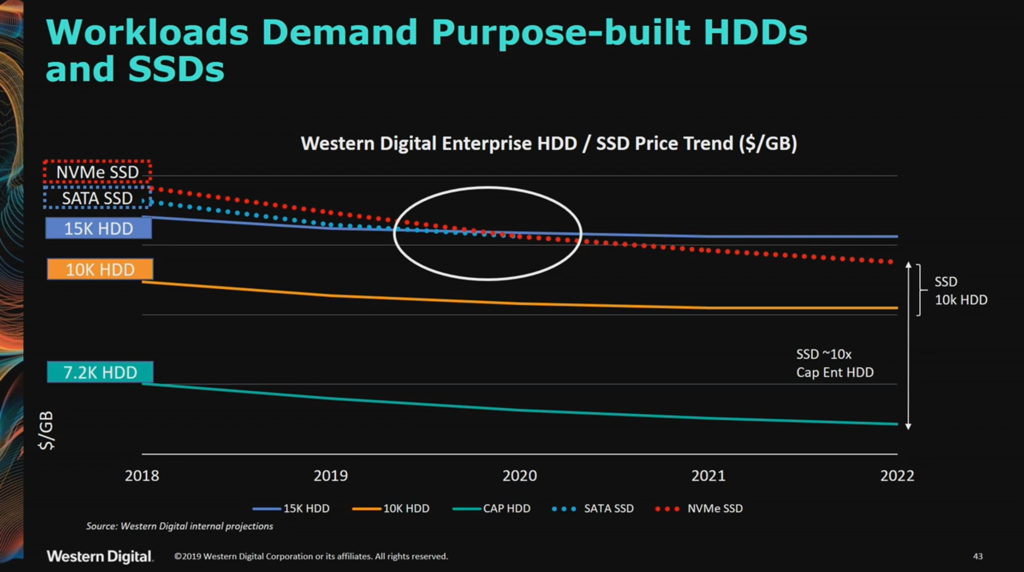

I found it intriguing that Western Digital maintains that there is still a price gap between the the 10K performance tier of disks and equivalent and that the world will remain hybrid for the foreseeable future. On the other hand, I’m seeing agressive moves in the midrange by players like Huawei who will price match 10K HDD with flash in their entry and midrange storage bays. Of course, much of the pricing around flash is often muddled by the fact that it is often sold by “effective capacity“, post compression and deduplication rather than by raw capacity so it’s hard to draw simple cost/Gb comparisons here.

One point that we’re all in agreement on is the constant conversion of Flash storage to NVMe attachment, but I found it very interesting that Western Digital is seeing and projecting significant growth of SAS and a drop-off of SATA as the primary interface for Flash in the datacenter. I would have thought that the arrival of SATA connected QLC, deployed in JBOFs would be driving out more HDD’s given the performance, density and energy consumption benefits, but it appears that the high capacity HDD is still in great demand in this space and that the SAS ports holding 10K & 15K drives are the big winners for new Flash drives.

From my side of the house, mostly in the mid-market, I’m seeing the use of targeted NVMe as a solution for fixing problems and improving what I like to call the Storage Admin’s MTTI (Mean Time To Innocence). They are certainly not getting anywhere near the potential performance of these new devices, but when they can point to a completely flat, sub-millisecond latency response on VDI and Database IO, it’s a lot easier to say quickly and definitively: “It’s not my fault”. From the Western Digital standpoint, this represents a tiny portion of the market compared to the much larger ML and Genomics installations that consume Petabytes of storage, but it’s clear that the market is ready for this technology.

There was some great discussion around the advancements in the HDD technology from the use of Helium, to the new technologies like MAMR, HAMR and SMR that are pushing the density to new levels. One thing that jumped out at me as a point of context was that in terms of volume sold, they segment the market by “Low Capacity“, Conventional Magnetic Recording (CMR) and SMR. Obviously the low capacity segment is also using CMR, but the interesting thing that came out of the discussion is that they see 10 Tb as being the threshold. That’s to say that anything under 10 Tb is considered low capacity!